It’s no surprise warehouse processes have grown more complex in the on-demand economy. Greater demand and higher customer expectations mean employees must move product through the warehouse as efficiently as possible.

Warehousing technology has evolved to meet these challenges, helping employees better track inventory through the receiving and put-away processes. While these advancements address concerns within individual warehouses, they don’t provide a solution for tracking inventory throughout the supply chain. Manufacturers needed a standard system to guarantee they’d have complete visibility into shipments as they arrived.

That’s why manufacturers in industries such as food and beverage turned to GS1 standards. GS1 is a not-for-profit organization that maintains standards for business communication.

GS1’s leadership in barcode innovation stretches back more than 40 years, but we’ve yet to achieve universal adoption of GS1 standards. Even some warehouses that work with GS1 standards maintain redundant barcoding processes.

Greater adoption of GS1 standards could transform the way we work with barcodes and help warehouse managers achieve maximum efficiency.

Barcodes: A step forward—but how extensive?

It wasn’t long ago that most warehouses relied on manual inventory processes. Trucks would arrive, workers would take stock using pencils and paper, and items would be placed on the shelf. For managers, however, these processes were headache-inducing: If one employee recorded a wrong number while receiving stock, the consequences would ripple across the warehouse.

RF scanners erased much of the manual burden—staff could scan a barcode rather than relying on a physical record. By adding an extra set of “eyes” to the receiving and putaway processes, warehouse operators were able to achieve higher levels of inventory validity.

Still, because these barcodes contained little information beyond item listing, it was entirely possible employees could miss inventory or count it incorrectly. Supply chain innovators have introduced various solutions for the issue; for instance, advanced shipping notices provide recipients with critical inventory information, giving their team greater visibility into what stock, and how much, should arrive.

However, GS1 standards deliver the same information—and because some of the world’s largest industries follow these guidelines, greater GS1 standard adoption is a natural solution.

GS1 labels: A standard for excellence

Companies that utilize GS1 labels comply with standards for what information is kept on barcodes—such as the weight of each case, or the quantity of cases. When you scan a GS1 barcode, you’ll know which, what kind, and how many of each product is located on the pallet. GS1 also provides standards for every step in the shipping process, including label placement and barcode color.

The challenge isn’t convincing warehouse operators to ship using GS1 labels—in fact, many warehouses receive shipments with GS1 tags on inventory, and many must place GS1 tags on items before they’re shipped.

Errors are likely to occur when warehouses place their own label on an item while it’s in inventory. This process not only wastes paper, but it also risks data loss or duplication. Because GS1 tags come with a unique identifier for the product and a unique serial number for each case that will never be duplicated, there’s no need for an internal barcoding system.

By adhering to GS1 standards, warehouses also improve traceability—a hot topic among supply chain innovators. Take, for instance, food manufacturers. Technology allows food and beverage suppliers to track every location a raw material has been during production. If there were to be an outbreak of food-related illness in a concentrated area, GS1 standards would provide manufacturers a common language to research and determine the contaminant.

Technology for a better supply chain

Today’s supply chain demands efficiency. As warehouses do more with less, demand rises for solutions that streamline operations. If you receive GS1-labeled inventory but maintain an internal barcoding system, it’s time to consider dropping the redundant process. If you don’t currently work with GS1 barcodes, consider moving to a system that helps improve inventory validity and traceability across your supply chain.

Chinese President Xi Jinping has announced plans to transform the entire southern island province of Hainan into a free trade zone (FTZ).

According to a guidance issued by the Communist Party and the State Council, China aims to establish the Hainan FTZ by 2020 and build a Hainan free trade port by 2025. By 2035, Hainan’s free trade system should be completely developed.

Hainan will benefit from relaxed rules for setting up medical institutions, importing medical equipment and pharmaceuticals, and allowing foreign doctors to practice.

Additionally, limited forms of gambling – namely horse racing and sports lotteries – will be permitted in Hainan, as previously rumored. Macau is currently the only jurisdiction in China that allows gambling.

In his announcement, Xi specifically referred to Hainan’s strategic positioning near ASEAN, which makes it an important location for trade with Southeast Asia. “Hainan has the advantage of being on the front line with ASEAN countries,” Xi said. “It should be a pioneer in opening up.”

Xi made the announcement days after his speech at the opening ceremony of the Boao Forum for Asia – which was held in Hainan – where he touted China’s new phase of reform and commitment to free trade and globalization. In his speech, Xi pledged to further open China’s markets to foreign investment and lower tariffs, but many observers were disappointed that he did not announce pilot reforms for Hainan, which were widely expected.

The announcement of the Hainan FTZ was made in celebration of the 30th anniversary of Hainan’s designation as a special economic zone (SEZ). Hainan, which is often referred to as China’s Hawaii due to its tropical climate and large tourism industry, was one of China’s first SEZs and among the first to benefit from the country’s reform and opening up.

China’s first FTZ, the Shanghai Pilot FTZ, was launched in 2013. In 2015, China announced the Fujian, Guangdong, and Tianjin FTZs. China announced seven more FTZs in 2016 – in Chongqing, Liaoning, Henan, Hubei, Shaanxi, Sichuan, and Zhejiang – to bring the total to11.

FTZs in China benefit from a number of incentives, such as reduced tax rates, expedited administrative procedures, and relaxed investment restrictions. Many FTZs also promote specific industries, allowing investors to benefit from cluster effects.

China’s FTZs are also known as testing grounds for policy experimentation, before reforms are expanded nationwide. As Hainan is an island province, an FTZ there allows the Chinese government to test reforms on a wider scale than other FTZs, yet still in a contained setting.

http://www.china-briefing.com/news/2018/04/16/china-establish-hainan-free-trade-zone.html

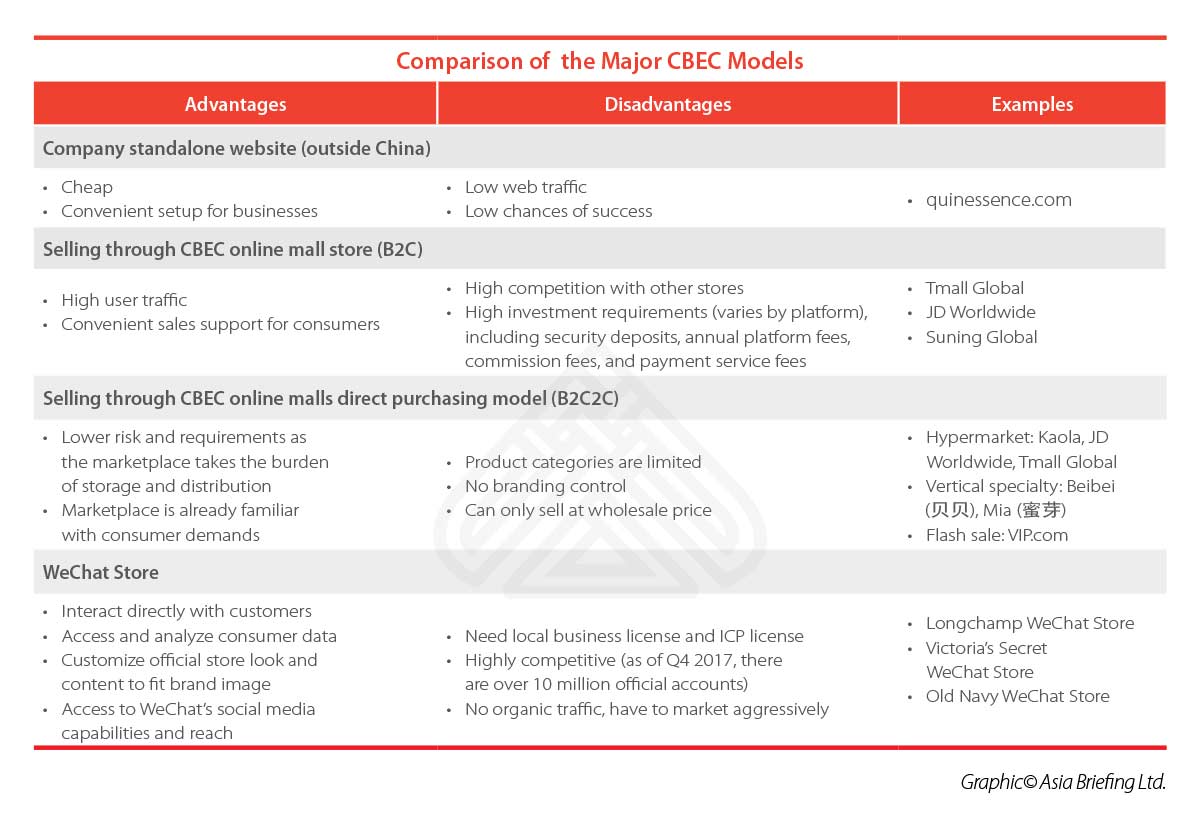

Foreign businesses that want to access the Chinese cross border e-commerce (CBEC) market first need to choose their model. Due to the varied nature of CBEC models and platforms, this can be a challenging endeavor, particularly for those unfamiliar with the Chinese market.The final decision depends on a strategic analysis of each model, and a breakdown of the main advantages and disadvantages facing the company.

Major CBEC Models

In this section, we outline the four models that foreign business may choose in order to do CBEC in China. These models are the methods in which investors can sell in China, either directly to consumers (B2C) or indirectly to consumers through a marketplace intermediary (B2B2C). Consumer to consumer selling (C2C) is excluded as C2C model is primarily carried out by a purchasing agent or“daigou”(代购), and not a formal business.

Company standalone website (outside China)

Many companies are attracted by the idea of having their own standalone website hosted outside of China. At first glance, this option appears to be the most convenient as it does not require a legal Chinese entity and is cost effective.

However, these websites often have low web traffic and interest from potential consumers. This is due to three main reasons.

First, if the website is hosted outside of China, Chinese consumers may not even be able to find or access the site. Secondly, there is already intense competition for Chinese consumer traffic waging between the giants of e-commerce in the country. Finally, these standalone websites often fail to provide customer supports that Chinese consumers demand, such as refunds, exchanges, Chinese payment methods (UnionPay, WeChat Pay, AliPay), after sales support, reliable delivery, and more.

Selling through CBEC online mall store (B2C)

Online malls are marketplaces that act as a centralized platform for different “stores”. Each brand can have its own store and operate it themselves. Consumers can purchase items from stores using the online mall’s checkout system.

This model has grown in user popularity as it is convenient and reliable for the consumer. The consumer can access a number of different stores, allowing them to “shop around”. Additionally, the single checkout system uses a familiar payment method (AliPay or WeChat Pay). Finally, the online malls allow consumers to talk directly with the shops, and offers easy and fast sales support.

Selling through CBEC online malls direct purchasing model (B2C2C)

In the B2B2C model, foreign businesses indirectly reach Chinese consumers because there is an intermediary marketplace where products are sold. There are three main intermediary marketplaces: hypermarkets, vertical specialty, and flash sales.

Hypermarket

In a hypermarket, there is only one shopfront. The hypermarket itself purchases goods directly from the overseas company, and adds it to their product stock. The product is then sold on the platform with a retail price.

Additionally, the goods are stored and delivered through the hypermarket’s own warehouse and distribution centers, reducing the logistics burden for the foreign brand. The foreign brand need only deal with the procurement manager with whom they can negotiate prices. Often, the hypermarket focuses on particular categories of products, such as wine, handbags, or milk powder.

Vertical specialty

Like hypermarkets, vertical specialty platforms also buy goods directly from the overseas supplier. However, these platforms focus on niche product categories, consumer demographics, or regions. Vertical specialty platforms are growing quickly as their niche focuses target potential customers better and leads to higher sales conversions.

Flash sale

As the name suggests, flash sale platforms offer limited quantities of products at discounted prices for a short period. Often, the goods are new to market, or surplus products. Flash sale platforms offer foreign brands the ability to market their goods in the Chinese market, or even to test out the popularity of various products.

WeChat Store

WeChat and WeChat Stores are an emerging CBEC method, but unlike the aforementioned models, it is primarily a social media app with related services. Despite this, its growing popularity and CBEC implications make it an attractive option for many foreign brands.

WeChat, originally a messaging app released by Tencent, has become a superapp – one that virtually everyone uses in China. Its functions have grown to include WeChat Pay, which allows users to pay their bills, order food and taxis, book appointments, buy tickets and more. WeChat Pay is now one of the leading payment methods in China, with almost 900 million active users.

Once a company has a verified account, it can open an in-store app through which it can sell directly to Chinese customers. The customers can then use WeChat Pay to buy the products.

As Chinese customers often get product recommendations through social media, the WeChat Store is a potentially powerful model.

Additionally, through the chat capability, brands can interact directly with the consumer. Finally, the brands can also access consumer data, which allows them to improve their services, products, and image.

In order to open an official WeChat account, companies are required to provide a local business license and an ICP license. Foreign firms can get around this requirement by either engaging a local party or a third-party agent, or engaging a local third-party WeChat e-commerce platform like WalktheChat.

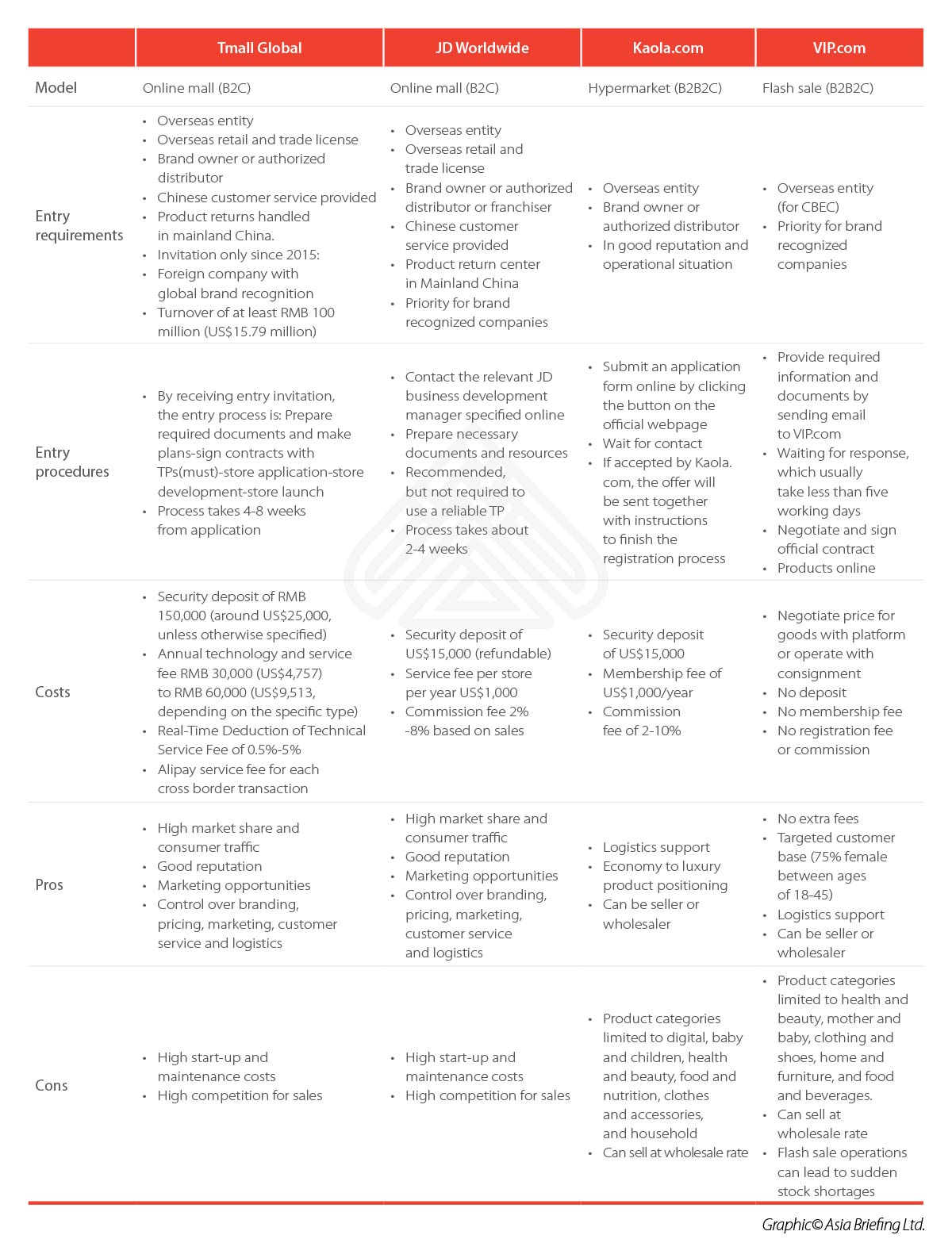

Platforms comparison

As the variety of existing CBEC models suggests, CBEC platforms are proliferating in China, and growing beyond the mainstays of Tmall Global and JD Worldwide. To be noted, with competition getting tougher and tougher, major platforms tend to use mixed models rather than one. For example, Tmall Global is traditionally focusing on online mall (B2C) model, but with direct purchasing model gaining great success, it launched its own direct purchasing channel as well. Kaola.com, originally focusing on direct purchasing (B2B2C) model, also expanded its business to allow third party stores entering its platform.

Entry strategy advisory

The options described above are just a small sampling of platform that foreign brands can choose from. The best-fit platform for a company should be based on a number of different considerations, but the main decision-making points include:

Product

Depending on the product, it may be advantageous to consider an array of specialty websites, like Beibei (for babies and children) or Yiguo (fresh foods), or others.

Funding

Some platforms, like Tmall Global and JD Worldwide, offer high growth prospects, but also require high startup and maintenance fees. Other platforms have lower fees, but slower growth prospects.

Market development plan

The platform will have a major impact on the brand and product’s image and branding in the market. Therefore, the platform (and model) has to be integrated into the market development plan.

Regulations and operations

Some platforms require a business to have more Mainland China capabilities. For example, Tmall Global and JD Worldwide require companies to have product return centers and Chinese customer service capabilities.

Of course, companies do not need to be married to one platform; they can pursue a multi-channel strategy. In this case, the investors should consider how the different platforms fit into their overall e-commerce plans, and overall market entry strategy.

While many companies still operate in ways that feel comfortable the technology tide in logistics is now turning. A growing number of companies are leveraging new technologies to enable end-to-end visibility into shipments, documents, costs, inventory, and invoices. That was the central message contained in a recent white paper from Armstrong & Associates.

The growth in ecommerce is accelerating that trend. Ecommerce now represents over nine percent of all retail sales in the United States, triple the proportion of ten years ago. Ecommerce logistics costs in the US reached $80 billion in 2016, and Armstrong & Associates expects to see a 19.9-percent compound annual growth rate through 2020.

As consumer expectations accelerate, shippers and logistics providers are using technology to develop competitive advantages.

“Getting ahead—or even keeping up—has become a matter of data,” the paper said. “Information must be shared accurately and instantaneously among the consumer, retailer, and logistics provider. Without such capabilities, some logistics providers will fall behind while industry leaders develop the next iteration of consumer-friendly technologies.”

Growing volumes of data are now available to companies, but most don’t know how to properly leverage it. Organizations can drown in all that data if it isn’t properly curated. Gartner predicts that 60 percent of big data projects will fail in the next year alone.

How can companies make successes of their data projects? The white paper provides a few clues.

All parties must be able to see the same information at the same time. All segments of the supply chain need the same visibility.

The information must be shared as soon as it is available. That way, all of the supply-chain players can have the longest reaction time possible.

The information must be actionable. Not all information is relevant to the task at hand. “A smart data collection system,” the paper concluded, “handpicks the most relevant and actionable data” and “delivers it to the people who need it most.”

Smoothly running logistics—a key factor in successful warehouse operations—depends on a three-legged stool of productivity, efficiency, and secure operations. Today, software underpins many warehouse functions, giving leaders a new source of productivity and efficiency insights—and a new concern for corporate security.

Measuring and Optimizing Productivity

Optimizing labor productivity is the number one goal within warehouse operations. Increasingly today, this means measuring employee output when using technology solutions such as warehouse and inventory management applications. Businesses need to obtain insights on technology-based productivity and use this data to further drive productivity.

First, you must have a starting point to measure and then improve. Take a snapshot of current productivity. What options are available within your warehouse and inventory management systems to track employee output? You may be able to determine insights from application reporting or logging within the application. Alternately, user monitoring software can provide information on application use, active vs. idle time, and similar productivity measurements.

Armed with data, you have several possible actions:

Identify employees who are top performers. Beyond the obvious rewards you might share with high-performing employees, you may discover techniques these employees use that can be shared with the team.

Identify where you might have overworked employees, and find ways to redistribute work more evenly among the team.

Identify employees who are lagging in performance, and determine if this is a result of unproductive behavior or an issue that could be solved with additional training on the application.

Embrace the competitive nature of many employees: Consider establishing a ‘leaderboard’ on the floor so employees can measure themselves against peers.

Productivity measurements based on application throughput provide another benefit as it can form the basis for fair and equitable performance-based compensation.

Efficiency Tips

Beyond productivity measurements, examining in greater detail how your employees are using your software applications is another way to enhance operations. This involves going beyond the transactions-completed perspective and looking at interactions from a process and usability perspective.

What errors are being captured in the applications’ logs? Errors are often an indicator of the need for further software training.

What issues and questions are being reported to your IT help desk? Reducing help desk tickets helps to drive efficiency and, here again, this may signal an opportunity for further training.

Among your high-performing employees, what actions are they taking to achieve high output? By looking at how high performers are using the applications to complete tasks, you can derive insights that might deliver greater efficiency across all team members.

Finally, go to the source: Periodically gather the team to ask for feedback on the software, identify what’s working (or not), and gather suggestions to streamline processes within your software.

Security Tips

Protecting inventory and securing the physical space of the warehouse have long been central priorities for organizations. The rise of software is requiring organizations to spend equal time and effort in cyber security. You must now take steps to protect valuable data in your network—your information and that of your customers, and be vigilant about the security of your supply chain.

To ensure security in the warehouse—and vet the security of your supply chain—consider these recommendations:

Ensure your warehouse employees understand the security policies and guidelines you’ve implemented to ensure data security. Periodic cyber security emails and face-to-face team meetings provide opportunities to reinforce security practices.

Limit who has access to critical data. Evaluate the roles in your warehouse, and segregate the data based on who needs to access the data to do their job.

Assess the risk within your supply chain: The supply chain was Ground Zero for significant breaches at Target and Home Depot. Ensure you are addressing information risk management in your procurement and vendor management processes.

There’s no doubt about it, the Internet of Things (IoT) has brought with it a whole load of changes. The ability for more and more physical objects to connect to the internet and share data without human help has transformed the way the world works.

From intelligent cars to biomedical sensors, the implications are huge – and as we move from 15 billion connected devices today to a predicted 50 billion by 2020, the changes will come quickly. But just how is IoT affecting the logistics industry – both from a business and a consumer perspective? Here’s what we know…

What is the Future of IoT?

A report by IDC and SAP predicts that IoT will lead to a 15% productivity increase in delivery and supply chain performance, and many logistics experts are using these new resources to improve systems and supply networks, reduce costs, and look for opportunities to generate more revenue too. But what practical applications does it have now, and what can we expect in the near future?

How Can IoT Help in the Warehouse?

Distribution centers are a fundamental part of logistics and supply chains, and as a result, any improvements or tightening of processes can have a massive implication on cost. There are many fundamental ways in which IoT is already helping in the warehouse and ways in which it will continue to grow:

Security

One of the most basic requirements for a warehouse is security of the product. Alarm sensors and CCTV both utilize IoT to detect theft and protect assets. New technology allows businesses to do more with their security. You can automatically lock doors using just an app, and receive alerts on unusual movements and then use the data captured to identify areas of concern and improve them.

Safety

Of course, one huge area of concern for logistics companies is the safety of workers. IoT is a valuable asset when it comes to monitoring the safety of your equipment and protecting your staff. According to this logistics report by DHL, Union Pacific uses IoT to predict equipment failures and reduce derailment risks. The company places sensors on tracks to monitor the integrity of train wheels, and as a result the company has been able to reduce bearing-related derailments, which can result in costly delays and up to $40 million in damages per incident.

Imagine if a fork-lift truck could alert you to the fact it has a defect before any human interaction has even taken place. You can greatly improve the safety in the warehouse and optimize your machinery. Plus, as a result of having more IoT available on the floor and less human interaction needed, the risk of accidents is greatly reduced too.

Optimization

Now this may not sound particularly new – many businesses have been using these types of technologies (or similar) for some years now, but IoT is at its most useful when all the data is combined together to give you a full picture of how your business is running.

IoT enables companies to have a holistic view of the warehouse floor – with everything from the ambient temperatures, the amount of inventory, and the performance of equipment all coming together. From this data, companies can analyze the overall performance and make tweaks to improve safety, security, and productivity.

How Can IoT Improve Delivery?

Driving greater operational efficiency is at the heart of logistics, and IoT can certainly give productivity a boost. One of the biggest areas in which it can make a difference is with vehicles and fleet management. Here are some key ways it can help:

Tracking

Thanks to companies like Amazon, customers now expect tracking on their goods right from the moment of purchase to delivery. However, in the past this has usually required someone to scan a barcode at at least one point in the process. RFID tags can connect to the cloud and share data on location and eliminate the need for staff to do anything other than load the delivery. So big are the benefits that according to Auburn University 96% of retailers are planning on adopting RFID technology.

RFID tags can also be used within the warehouse to track inventory and help to cut down on unnecessary costs too. In fact a report by the RFID Journal suggests that inventory accuracy at the stock-keeping unit level is about 65%, whereas RFID can get it up to 95% or better.

Delivery

Ever had a delivery delayed due to bad weather or unsafe road conditions? With GPS and location data from RFID tagging, a fleet can be proactive rather than reactive and utilize technology to stay informed and avoid possible delays. As the increase in drop shipping may lead to a consolidation of delivery carriers, we could see a more standardized delivery experience emerge.

Analytics

Of course you can also make use of all this data by analyzing it and improving your workforce. Big data can help you see which drivers are the most efficient, seek out preferred routes and identify inefficiencies. You can then train all staff to ensure your company is optimizing every opportunity available.

What IoT Means for the Consumer

So, we now know how IoT can be beneficial for you, but what about your customers? Here are some key ways their worlds are changing too:

1. Transparency

Now more than ever, consumers value trust and reliability above all else when making a purchase. Tracking information sent directly to a smartphone app will give your customers confidence in your service and, providing everything remains on track, removes any need for calling customer helplines too.

2. Efficiency and Ease

All that gathered data will also make buying patterns and behavior much easier to spot. Automatically setting up repeat purchases if needed, and mobile payments like Apple Pay, all add to the ease of the shopping experience and improve customer satisfaction.

3. Recognition and Rewards

Of course, with all the information gathered by IoT you can also start to track your most loyal customers and look at where they spend their money. This allows you to offer rewards to your best customers and gives you marketing opportunities and the potential to upsell too.

The new age of IoT is an exciting one for logistics. With so many opportunities to streamline chain management and optimize every element of production, the possibilities really are endless. Customers too will see the benefits with easy-to-track deliveries, an improved shopping experience and greater rewards. All in all, the dawn of the IoT will bring with it many changes in 2018 and beyond – we’re just getting warmed up!

There are industry concerns over Amazon’s ventures into logistics, with one operator admitting it could find itself competing with the e-commerce giant.

Chief executive of DHL Express Ken Allen stood firm on his belief Amazon posed no threat to his company’s future, but told The Loadstar there was a potential threat on the domestic front.

“It could compete with Deutsche Post in Germany, but I don’t see it – at least immediately – offering a service from, say, Australia to Nigeria,” said Mr Allen.

“Therefore, entering the express market would be difficult for it because it does a lot domestically, but express is an international business, and the bulk of our volumes are global.”

FedEx and UPS share prices both took a hit after Amazon announced it would be taking greater control and handling more of its customers’ deliveries.

And Mr Allen is not the first CEO to voice – admittedly muted – concerns over an Amazon encroachment into the logistics arena. This month, chief executive of Maersk Soren Skou told Bloomberg he was worried that the likes of Alibaba and Amazon could become competitors within “just a few years”.

Mr Skou said: “If we don’t do our job well, then there’s no doubt that big, strong companies like Amazon will look into whether they can do better themselves.”

Furthermore, Mr Allen pointed to unwillingness, or inability, among traditional delivery companies to scale-up when the e-tailer faced peak periods and surging demand.

He said: “Amazon is changing the way people buy goods, and if it cannot get the volumes from traditional operators it will end up doing things itself. In fact, if I was a domestic-only player I’d be looking at the synergies it could offer – perhaps in terms of capacity utilisation.”

Controlling the entire supply chain would not only improve Amazon’s flexibility, but give it greater levels of data to increase efficiency processes.

Historically, Amazon has been written off by legacy players when entering new markets, many laughing-off its prospects in fresh produce prior to its $13.7bn acquisition of Whole Foods.

When pushed, Mr Allen reiterated his belief that Amazon’s only interest would be on the domestic front, with a spokesperson noting this is a small market for DHL Express.

“Domestic operations are not a major focus for DHL Express, which is why we exited the big markets,” said the spokesperson. “Our last results showed it accounted for around just a 6% share of revenue, as our focus remains on the cross-border business.”

Alibaba, China's biggest e-commerce company, reported a 56 percent increase in third quarter revenue, beating analysts' expectations as the firm shrugged off any concerns about a market slowdown.

The company also said it would buy a 33 percent stake in its payment affiliate Ant Financial in exchange for certain intellectual property rights owned by the e-commerce giant.

Revenue for the October-December period rose to 83.03 billion yuan ($13.19 billion), up from 53.25 billion yuan a year earlier.

That exceeded the 79.8 billion yuan average estimate of 28 analysts polled by Thomson Reuters.

Alibaba saw its shares nearly double last year on the back of strong sales and is currently valued at $523 billion, but is now looking to fend off a growing challenge from rivals in its key retail business that analysts expect will drag on growth.

Net income attributable to shareholders rose to 24.07 billion yuan, or $1.41 per share, up 34.8 percent from 17.9 billion yuan in the same quarter a year earlier.

That compared with the 21.5 billion yuan estimate of analysts surveyed by Thomson Reuters.

Revenue from Alibaba's core commerce business rose 57.3 percent. The company typically reports higher revenue in the third quarter due to the Singles' Day sale held on Nov. 11, the world's biggest sales event.

Cold storage and temperature-controlled distribution have significantly advanced the food supply chain since being introduced just over 100 years ago. Before then, food preservation was relatively limited to salting and drying; otherwise, you consumed food after it was harvested and before it went bad. Citrus fruits in winter? Not likely!

What started with blocks of ice being cut from lakes in northern states during winter months and preserved using hay, has evolved into the advanced cooling and transportation techniques we all now take for granted.

The demand for cold storage and distribution can arguably be linked to the rise of the middle class, and the demand for fresher foods. And as demand increases, so does temperature-controlled storage and distribution. Capacity is readily being added to major U.S. and emerging global markets on a near constant basis.

According to the U.S. Department of Agriculture’s National Agricultural Statistics, there was 4.17 billion cubic feet of gross refrigerated storage capacity in the U.S. on Oct. 1, 2015. This represents a 3 percent increase in refrigerated warehouse capacity in the U.S. since 2013.

Add to that the services that cold storage and distribution companies are incorporating to attract more business, and it soon becomes obvious that the industry is ratcheting-up its viability as a differentiator for its customers.

In recent years, there’s been a growing interest in the humane and wholesome raising of animals, growing of fruits, vegetables and the desire to reduce superfluous activities between the farm and the fork. This consumer demand has led to an increase in the number of companies adhering to more socially acceptable standards.

You may have noticed the number of aisles in your local supermarket being dedicated to fruits, vegetables, fish and meat. Such increases are the direct result of this increase in consumer demand.

Once these products hit the markets, the sheer volumes of companies vying for retail space on shelves are incredible. There’s also the need to appeal to consumers by pricing products appropriately. So, those wholesome food producers are always looking for efficient and effective processes to balance costs for the production and sale of their product versus the prices consumers receive.

In addition to the farm-to-fork movement, consumers are looking for convenience. Individual packaging, and fresh, nutritious ingredients, available quickly, and even delivered during a predetermined window: Welcome to e-commerce.

In today’s society, anything we want or need is just a click away, including food! From ordering groceries online to ready-prepared meals, and fast-food delivery, consumer convenience is at the helm of such growing market trends, saving time in what some believe is a better use of their time. In fact, according to the Food Marketing Institute and Nielsen, grocery is the next big retail sector to be affected by e-commerce. Their recent study suggests by 2025, 20 percent of all grocery spending could be online. That’s $100 billion in annual online consumer sales.

There is a lot of opportunity for temperature-controlled service providers to appeal to food producers and food retailers with additional value-added services to cater toward the new norm of consumer demand. And temperature-controlled service providers are stepping-up! Tailored solutions can enable food producers to continue to produce goods in larger, economic volumes, and then leave repacking, relabeling, kitting and even order fulfillment to the service provider.

SHANGHAI -- With half of the world's parcels now being delivered in China, thanks to the explosive growth of e-commerce in the country, domestic and foreign logistics providers alike are bolstering capital investment and striking new partnerships in hopes of taking a bigger slice of the pie.

According to China's State Post Bureau, 40 billion parcels were delivered in the country in 2017 -- up 28% from the year before. The figure has increased 33 times just in the last decade, thanks to the rise of e-commerce titans like Alibaba Group Holding and JD.com.

"I shop online at least 20 times a month," said one restaurant worker in Shanghai. The 26-year-old relies on the internet for most of her shopping, from clothes and cosmetics to even groceries. She checks her smartphone frequently to see where her packages are.

The couriers often miss the designated delivery window or leave packages unattended outside her front door, but she does not seem to mind. "I get the items in one to three days, so it's convenient," she said.

The State Post Bureau expects parcel delivery to increase another 20% this year to 49 billion. To deal with surging demand, SF Holding, China's largest delivery company, had expanded its fleet of cargo planes from 11 in 2013 to 40 by the end of 2017. It is planning a further increase to 55 over the next three years.

Related stories

- Yamato teams up with JD.com to deliver goods across China

- Dalian Wanda wins $5.4bn injection from Tencent-led group

In China, many leading logistics providers outsource their deliveries to smaller contractors or even individual couriers. But SF Holding has bolstered the quality of its services by handling the entire delivery process in-house. Its sales jumped 23% on the year in the first nine months of 2017 to 49.8 billion yuan ($7.86 billion), and net profit by 11% to 3.6 billion yuan.

Online retailers are also making inroads in the logistics sector, which they consider crucial to their own success. Alibaba said in September that it would invest 100 billion yuan in logistics research over five years. Subsidiary Cainiao Smart Logistics Network will team up with SF Holdings and other logistics providers to create more efficient warehouses and a delivery network in rural areas, with the eventual goal of guaranteeing delivery anywhere in China within 24 hours and overseas within three days.

But the logistics sector faces narrowing margins. Due to growing competition, e-retailers have been offering perks like free shipping for purchases of a certain value. This in turn has squeezed shipping prices from 30 yuan a package in 2006 to just 13 yuan in 2016.

Meanwhile, labor costs are on the rise. The shortage of workers, most of whom are migrants from rural areas, also led to widespread delays and lost packages at the beginning of 2017.

JD.com is both building an in-house delivery system and developing power-saving technologies, like automated warehouses and self-driving trucks. It opened a fully automated distribution facility in Zhejiang Province at the end of 2017. It has also begun delivering packages to rural villages using drones.

From drones to unlikely tie-ups, companies get creative to meet e-commerce demand

WATARU KODAKA, Nikkei staff writer

"Given the surge in labor costs, there will come a time when delivery technology will be the determining factor of how competitive an online retailer is," a JD.com official said.

The growth of China's middle class and a boom in international travel are also fueling a rise in online purchases from overseas. Deliveries from outside mainland China, including from Hong Kong and Taiwan, jumped 34% to well over 800 million parcels last year, data from the State Post Bureau shows.

U.S. delivery company FedEx recently opened a 130,000-sq.-meter logistics center outside Shanghai with an automated sorting system capable of processing 36,000 items per hour. Karen Reddington, president of the Asia-Pacific division of FedEx Express, expects Chinese demand to grow further, citing e-commerce and the Belt and Road Initiative.

Businesses are teaming up to handle the expected increase in workload. JD.com is partnering with Japanese courier Yamato Holdings to get products from Japanese and other retailers into Chinese consumers' hands faster. SF Holding established a joint venture with American peer UPS last year.

Under an agreement with Alibaba, Nippon Express transports goods and handles customs clearance for exporters shipping to China. The Japanese company is also launching a joint project with a Chinese university to use new technology to improve efficiency in warehouse operations. "We're focused on technological innovation in China," a Nippon Express executive said.

The layman might envision warehousing storage services as simply a very large storage unit where pallets of bulk shipments simply sit and wait.

Yourkey Warehousing professionals recognize that there’s much more to safe and efficient warehousing than a lot of building space. Savvy businesses find warehousing in highly accessibly areas, like Hong Kong, Shenzhen, Guangzhou, Shanghai, Ningbo and Xiamen so that goods are within quick reach of end users. But location access isn’t the only critical component of smart warehousing. Technology is key. Yourkey Warehousing has implemented a secure, state-of-the-art, web-based Inventory Management System, allowing you to view your inventories anytime and from anywhere. EDI and barcoding capabilities are included, which enables you to organize your resources and optimize your fulfillment and distribution processes. Keep track of everything from start to finish with this exceptional system.

There are more about our warehousing services as below.

Yourkey Warehousing Logistics

Contract, Public and Food Grade Warehousing

Full-Service Fulfillment

Container Unloading and Cross Docking

Pick and Pack, Repack, Sort and Segregate

Kitting and Assembly Services

Local and International Logistics

Distribution

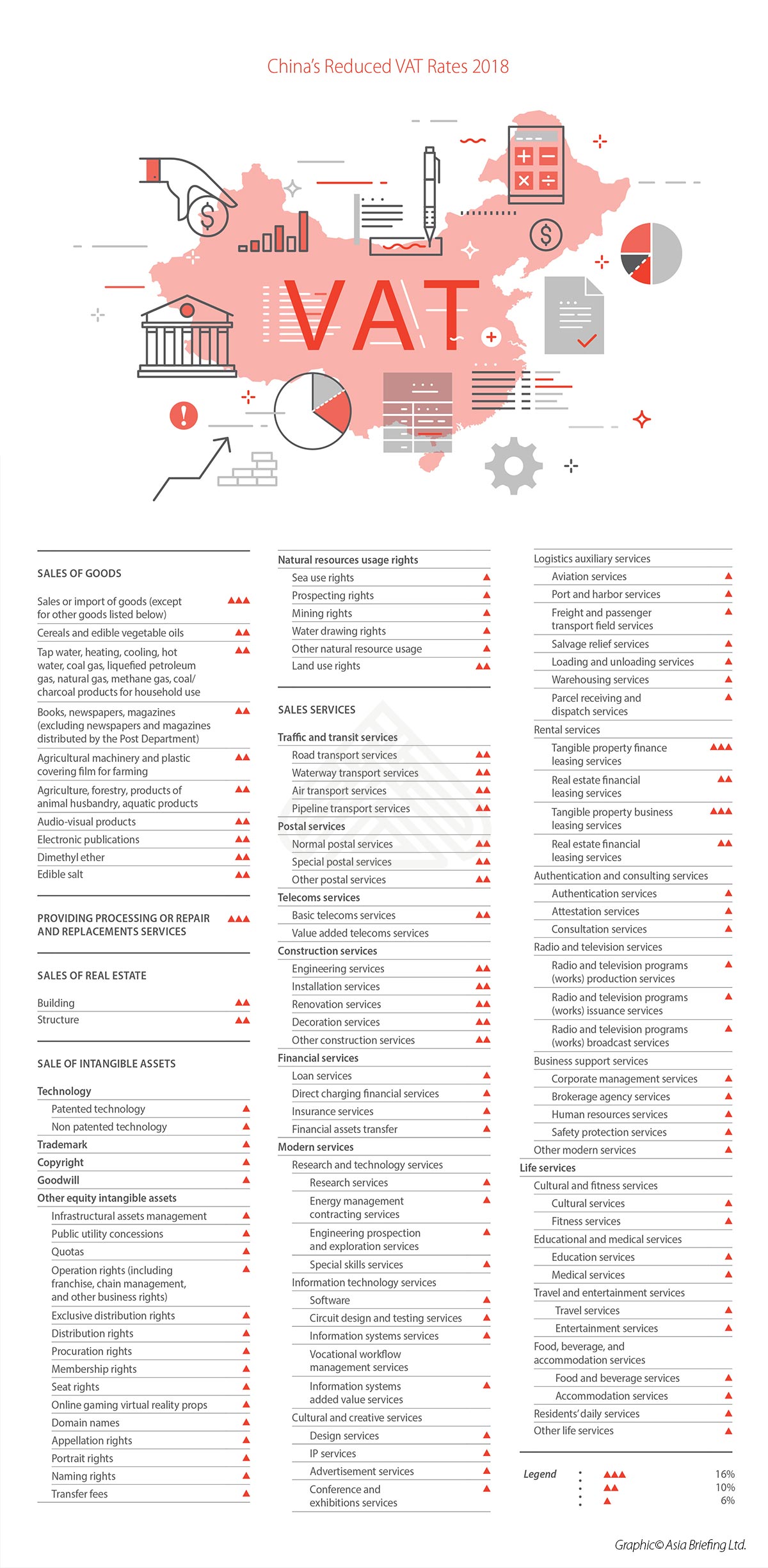

China recently lowered its value-added tax (VAT) rates, as part of an RMB 400 billion (US$64 billion) tax cut package.

The Ministry of Finance (MOF) and the State Administration of Taxation (SAT) recently released the Circular about Adjusting the Rates on Value-added Tax, which explain the details of the new VAT rates.

According to the circular, the tax cuts reduce the 17 percent VAT bracket to 16 percent, and the 11 percent VAT bracket to 10 percent. The six percent VAT bracket remains unchanged. The new VAT rates will go into effect on May 1, 2018.

The MOF and SAT also recently released the Circular about Unifying the Standards of Small VAT Taxpayers, which expands the criteria for firms to qualify as a small-scale VAT taxpayer. Small-scale VAT taxpayers are now defined as those whose annual sales are less than RMB 5 million (US$796,330). Before, there were three different tiers of small-scale VAT taxpayers.

The tax cuts are part of an ongoing effort to optimize the VAT system and reduce companies’ tax burdens. At the annual Two Sessions meetings in March, Premier Li Keqiang stated that the government aims to further streamline the VAT system by reducing the number of VAT brackets from three to two.

China’s updated VAT rates follow.